A. Previous post | summary

Last week introduced the intention for this series of posts on the US healthcare system. This week’s post provides background on the evolution of the US healthcare system.

B. How does insurance work

Before reviewing the background of US medical insurance, let us review how other forms of insurance work, as the value proposition is quite different from medical insurance.

- Auto: auto insurance is mandated in the US; it protects people against catastrophic financial loss in the event of an accident. Car insurance doesn’t cover oil changes, tire rotations, or other vehicle maintenance; these costs are paid for by the car owner.

- Let us consider the situation when a person takes their car to the local dealer for maintenance. The person receives an estimate for the repairs; if the scope of work expands, a revised estimate is provided before proceeding with additional repairs.

- Contrast this with a medical procedure; you don’t know the cost in advance; if you’re at a hospital, you don’t know if a specialist (ie. anesthesiologist or radiologist) is out-of-network, even within an in-network hospital; and it’s likely that when you receive the bill, that you may receive multiple bills from each of the service providers (ie. surgeon, anesthesiologist, facility fee, etc.).

- May you imagine going to dinner, ordering from a menu without prices, and leaving dinner, not knowing how much you owe; further, when you receive the bill, you receive multiple bills; one from the hostess who seated you, one from the bartender or sommelier, one from the waitstaff, one from the chef, one from the sous chef, and one from the dishwasher.

- Homeowners: homeowners insurance protects people against catastrophic financial loss against a home, very often, a person’s primary asset (actually, it’s a liability, because a house is often a negative cash outflow). Homeowner’s insurance provides protection against damage, for example, if a tree falls on the house during a hurricane. Homeowner’s insurance doesn’t cover the cost of repairing the refrigerator, or replacing the hot water heater.

- Medical: medical insurance typically includes co-pays, co-insurance, and deductibles, with an annual maximum out-of-pocket expenditure limit; it provides access to certain networks at “reduced” rates. The insurance companies require reduced rates from providers (ie. hospitals, specialists, physicians, etc.), and so these providers often artificially increase their list prices (ie. charge master) in order to provide the insurance company its required discount. Un-insured, or cash-pay customers, are often charged these artificially inflated list prices.

- US has a market for health insurance; it’s possible to comparison “shop” across various insurance providers to compare premiums and benefits.

- The costs that a person pays for health insurance, is generally consistent with the medical costs that are expected to be incurred; the insurance companies have talented actuaries who review this data, and may estimate with certainty the costs to be incurred based on a person’s age and other demographic information.

- A 20% mark-up is included in the insurance premium; 5% is allocated by the insurance company as a commission to the underwriter (the person responsible for “writing” the contact); and 15% is the insurance company’s profit; ACA requires that insurance companies pay out 80% of premiums towards claims, otherwise, pay a penalty (100% premium less 5% commission less 15% profit margin = 80% claims paid).

- If a person enjoys gambling, it’s difficult to beat the house odds; in other words, over time, the casino is going to win; insurance companies aren’t different; the insurance company is going to profit.

- US does not have a market for healthcare, currently; costs are not transparent.

C. Background | primer

- Before the development of medical insurance, patients paid out-of-pocket for medical costs on a fee-for-service business model

- One of the first medical insurance plans was launched in Dallas, Texas (1929) by Blue Cross, where patients pre-paid for hospital services, in the event of serious illness

- Social Security was approved by the Roosevelt administration (1935); the primary focus was to mitigate unemployment, and healthcare was “left out of politics”

- Employer-provided healthcare was launched during World War II, as a means to attract employees, due to federally mandated wage controls; these fringe benefits were excluded, and continue to be excluded, from taxation by the IRS. One could estimate the 2021 tax base of these fringe benefits at $1.6-trillion.

- Truman administration proposed public (universal) health insurance (1945), but was strongly opposed by industry groups, including the American Medical Association (AMA) as “socialism”

- Because health insurance was not available to unemployed, elderly, or poor individuals, the Johnson administration enacted Medicare and Medicaid (1965); former President Truman received the first Medicare identification card. Medicare provides healthcare coverage to individuals over the age of 65, or those individuals with long-term disabilities, including end-stage renal disease (750,000 Americans). Medicaid provides healthcare to low-income families, and children up to age 18.

- Clinton administration proposed universal healthcare (1994), but was strongly opposed by the insurance industry and large employer groups

- The second Bush administration approved Medicare Part D (2003), providing voluntary outpatient prescription drug coverage for citizens over age 65

- Obama administration approved Patient Protection and Affordable Care Act (ACA) (2014), providing insurance coverage to individuals with pre-existing conditions, and reducing, but not eliminating, uninsured Americans from 18% to 8% (28-million).

D. Cast of characters

Primary insurance carriers, sometimes referred to as BUHCA, represent 55% of the market, with combined revenues of $677-billion:

- Blue Cross Blue Shield (Anthem): $122-billion | 12%

- United Healthcare: $257-billion | 14%

- Humana: $77-billion | 8%

- Cigna: $160-billion | 10%

- Aetna: $61-billion | 11%

Pharmacy benefit managers (PBMs), are third-party administrators of prescription drug programs for commercial health plans, and are responsible for developing and maintaining the formulary, contracting with pharmacies, negotiating discounts and rebates with drug manufacturers, and processing and paying prescription drug claims. The three PBMs below serve 78% of the market with 180-million Americans:

- CVS Health (previously CVS Caremark)

- Express Scripts

- Optum Rx (subsidiary of United Healthcare)

Other Pharmacy Characters

- GoodRx: founded in 2012, allows individuals to compare prescription drug prices and find coupons at more than 60,000 pharmacies. Using a GoodRx coupon, and paying with cash, individuals may access the PBM rates for a prescription; these rates may be lower than the rates available to insured patients. GoodRx makes money buy splitting the commission paid by the pharmacy to the PBM and GoodRx. GoodRx is often accepted at large pharmacies (ie. CVS, Walgreens), but not at independent pharmacies.

- Cash-pay: cash-pay pharmacies do not accept insurance; these may be brick and mortar, or on-line pharmacies. These pharmacies may issue 90-day prescriptions, and typically offer a flat fee for each prescription filled. Avoiding insurance companies and PBMs, cash-pay pharmacies may offer lower prices than traditional pharmacies, more transparent pricing, and often focus on the use of generic drugs.

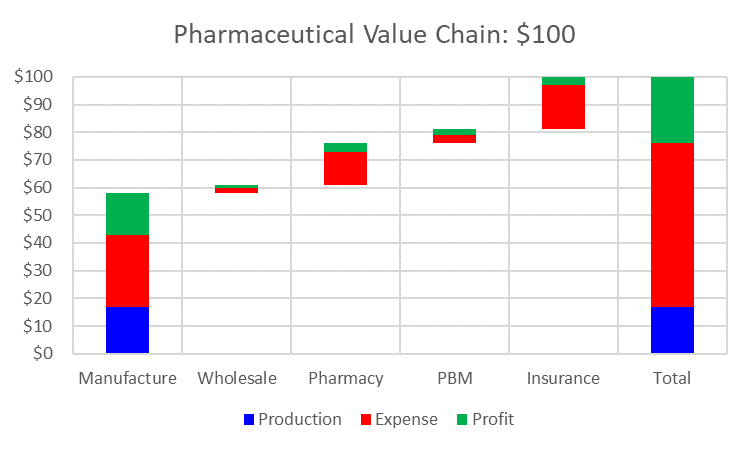

Pharmaceutical Value Chain

Let’s assume the scenario where a patient purchases a $100 prescription.

- Profit margin (all parties): 24%

- Production cost: 17%

- Source: USC Shaeffer Center for Health Policy & Economics (2017)

E. Looking ahead | next post

Next week’s post will share additional background information, presenting key trends of the US healthcare system, including potential risk areas (ie. cost), and quality measures.